The new requirements for CSP Direct: Is license administration part of a Microsoft Dynamics partner’s core business?

CSP

Strategic

Microsoft is changing the rules of the Cloud Solution Provider (CSP) agreements with her partners as we speak. These changes will especially impact the businesses of partners that have selected the CSP Direct option. Some of them should even consider switching to the CSP Indirect scenario.

As most partners know, tracking and adapting to the latest updates to Microsoft’s partnership model requires significant time and effort. To help the wider partner community understand what’s going on and facilitate their decision-making process, Guus Krabbenborg interviewed Nelson Tavares da Silva, who is deeply involved in this domain. Nelson is VP Business Development at QBS group, one of the leading indirect Cloud Solution Providers (CSP) and the largest Microsoft Dynamics community worldwide. Within the QBS organisation, Nelson is business responsible for the CSP program. For more than two years he has been intensely involved in the CSP program and he has delivered presentations on CSP at international events for Microsoft Dynamics partners like Directions EMEA.

Guus: As a refresher, can you summarize what CSP is today?

Nelson: The Cloud Solution Program (CSP) is a program that helps Microsoft partners to create their own bundle of cloud solutions and cloud services, combined with their own IP and IP-related services. Via the CSP program, those partners can manage, offer, order, deliver, invoice and support that unique bundle to their end-customers all over the world. The purpose of this program is to create additional partner value, to strengthen the partner-customer relationship, and as a result, improve the partner’s profitability.

CSP became relevant for some Microsoft Dynamics partners when Office 365 became available in the CSP contracts. Today, CSP is crucial for every Dynamics SMB partner since Dynamics 365 Business Central is only available via CSP. This means that every modern Dynamics partner on the globe must join the CSP program. And make a choice regarding the level of engagement.

What are your observations regarding the uptake of CSP in the worldwide Dynamics partner channel?

Let me share a few observations. First and foremost, many partners focus on prices and margin levels only and tend to ignore the cost side of the story. To me it seems like most of them have missed the essence of the program, which is about creating additional customer value.

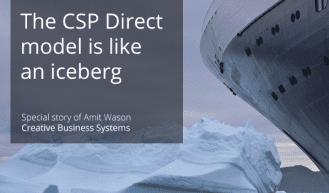

Secondly – there still is confusion about the two models. They are called Direct and Indirect (aka Tier 1 and Tier 2). The Direct CSP option seems to be perceived by many partners as superior to Indirect CSP due to the direct link with Microsoft. As if it is an acquired right.

The next observation is about CSP knowledge. There is still a lack of knowledge regarding the content of the CSP program. And I fully understand that. Microsoft has an ongoing job in positioning CSP and explaining the options. However, it’s fair to say that the amount of information is nothing less than huge! Often it feels like an information tsunami. I myself spend 20 to 30 percent of my time to stay up to date on all the ongoing changes, and that’s just high level knowledge! In our Partner Care team, we have several fulltime colleagues, active in all the CSP details and they spend even more time on this.

Being proactive in CSP in both knowledge and actions will cost the average Microsoft partner at least half the time to a fulltime staff member. This depends, of course, on the number of solutions and the transaction volume. I’m really wondering whether that aspect is sufficiently considered in the choice between CSP Direct and CSP Indirect.

Finally, many SMB partners have grown their businesses based on a ‘do it yourself’ mentality. But with the complexity of CSP, the current pace of change and the growing volumes, this becomes impossible. Which brings back the question: why not outsource this?

How many partners use CSP as it is intended – bundling products and creating additional customer value?

In my view, maximum 20 percent of the partners that we as QBS Group oversee do an effective job of bundling and adding additional value. The remaining 80 percent use CSP as a transactional system only. By doing so, they miss the opportunity to add value and leave money on the table. Maybe even worse – they open the door of their customer base for other partners.

What are the recent changes regarding the CSP Direct status?

The biggest change in my opinion is that Microsoft finally decided to start enforcing the known rules for CSP Direct. In the recent past, many partners have chosen the Direct option because of the higher margins and had little “burden” of this enforcement. But that is really changing now.

These are the requirements for CSP Direct that Microsoft will enforce:

- Delivering support to end-customers, supported by mandatory support contracts that partners must close with Microsoft. The minimum costs for these contracts are $ 15K per year ($ 10K for partners in emerging countries). Premier support contracts start at $ 100K per year.

- Automation for the links to the Microsoft MS systems. So far it waspossible to do this based on Excel. However, that is not allowed anymore. CSP Direct partners must have a ‘real’ system that connects with the Microsoft systems.

- Provide at least one managed service, IP service, or customer solution application.

CSP Direct partners are expected to demonstrate and prove that they offer at least one of these three categories.

- Have the infrastructure in place to manage customer billing

Microsoft expects CSP Direct partners to have a billing and provisioning infrastructure in place to manage their cloud customers and scale.

According to Microsoft, ‘these new requirements strengthen our business and technical relationship with partners who provide their customers with cloud products, support and direct billing’. The new requirements will take effect August 31st, 2018.

So what does this all mean for Microsoft Dynamics partners?

I’d like to answer this question for three different groups of partners. First the partners that have selected the CSP Indirect option. For them, nothing changes at this moment. The second group are the CSP Direct partners. They will experience many changes! They have already made several investments and are now confronted with a dilemma: either change to the Indirect option and disinvest? Or making the additional investments. But how big is that investment?

In addition, these are not the latest changes since Microsoft claims that the model is not finished yet. Products are continually being added and Microsoft continues to optimize the rules. This means that this additional partner investment is certainly not the last one.

The third and last group are those Dynamics partners that have not made any decision yet. For them it’s important to know that Microsoft has decided to not accept any new CSP Direct partners until August 1st, 2018. These partners either must wait until that date (but still need to adhere to the new requirements) or select the Indirect option now. For them it’s important to remember that Dynamics 365 Business Central (the SaaS offering) will only be available via CSP.

More generally I expect that Microsoft will continue to raise the bar. For example, by introducing a certain revenue level for CSP Direct. This has been mentioned before but so far not communicated in public. So being accepted and keeping the CSP Direct status will become even more difficult over time.

Where do you see the turning point in CSP revenue for a choice between Direct and Indirect?

So CSP Direct partners are confronted with higher costs. They must take all these additional costs out of their higher margins. Based on the current requirements, I see the turning point in CSP revenue is roughly around Euro 350K. Partners that have a structural revenue below this turning point do well anyway to choose for the indirect option.

In your opinion, what is the Microsoft strategy regarding CSP?

It is crystal clear that Microsoft bets on a larger part of her Dynamics partners landing in the CSP Indirect model. Rumors say that Microsoft strives for 85 percent of all current CSP Direct partners to move to CSP Indirect, simply because that fits their business model. If they do not manage that result with this set of rules, there will undoubtedly be more tightened rules. Microsoft wants to get rid of all the administrative activities.

Any final considerations or advice for Dynamics partners?

The key question that every Microsoft partner’s management team must ask themselves is whether license administration belongs to their core business. Think, for example, about the administration of the cars from your staff. Is that really something you would like to do yourself? And does that help you win more deals? Or do you prefer to outsource that to the lease company? It is a similar story with the licenses, since the need for knowledge will greatly increase due to the move from ‘stand-alone’ Dynamics NAV or Dynamics CRM to the Microsoft stack. The average Microsoft Dynamics partner has about 25 employees. Is it worthwhile to dedicate one of them for this specific CSP task? Knowing that you’re still vulnerable in case of absence due to holidays or sickness. Or departure. Wouldn’t it be much better and more profitable to partner with an Indirect CSP and dedicate that additional employee to your marketing or sales staff?

Need help in getting started with CSP? Read more on the QBS group offer here or contact us directly

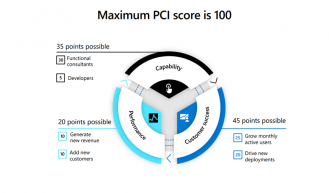

Microsoft CSP QuickScan

For you as an existing Microsoft CSP Direct Partner, what is the best approach: stay Direct or go Indirect by selecting the right indirect CSP provider? (Max 60 seconds)