Customers know what they want – or do they?

By Hans Peter Bech

“Customers don’t know what they want until we’ve shown them.”

That’s a quote often ascribed to Steve Jobs following Apple’s launch of the iPod, the product that saved the company’s life. It’s in line with another famous quote:

“If I had asked people what they wanted, they would have said faster horses.”

Henry Ford has been credited this quote, but apparently never said it. However, it is reasonably apparent that asking the average traveller in 1903 about the future of transportation only a few would have mentioned the potential of the combustion engine. It was around the same time (1915) that Peter L. Jensen and Edwin Pridham invented the loudspeaker, and no one had a clue for what to use it. It wasn’t until 1919 when president Woodrow Wilson was to address a crowd of 50,000 people at the Balboa Stadium in San Diego that at least one application of the loudspeaker was made apparent.

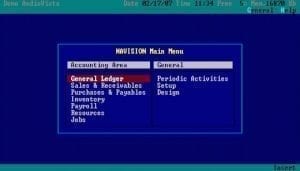

The history of ERP systems

The first wave of digital transformation swept across the SMB market with the appearance of the PC from 1985 to 1990. The second wave was led by Navigator/AL (1990) and Concorde XAL (1991) that offered SDKs with the add-on and customisations opportunities for partners, customers and industries. The third wave was spearheaded by the global acceptance of Microsoft Windows that with the 95 version became the industry standard operating systems platform. Navision Financials was the first financial management application to be certified for Windows 95, and in 1998 Axapta followed suit.

By the beginning of this century the PC had out-competed the mainframe, and the minicomputer as the preferred business application platform and most SMBs were on their second or third generation solution.

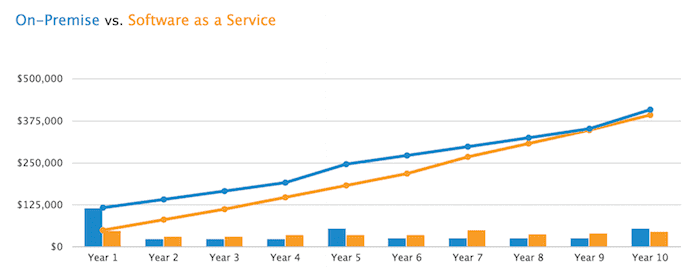

We are now in the midst of the fourth wave where software is delivered as a service from (huge datacentres in) the cloud and many more technologies are available to support many more business processes than ever before. The industry hype cycle changes faster than ever introducing new buzz words and making new promises of improved business benefits for the customers.

Today all SMB customers migrate from one digital solution to another, although to a different and more comprehensive, digital solution. Does that mean that customers today are better qualified to specify what they want? Alternatively, does technology develop so fast that there still is a substantial gap between what they know and what is possible?

I have interviewed three Microsoft Dynamics partners in three countries and an independent consultant to find out what their take on the situation is – what do customers tell them, and what do they believe the future has in store for us.

The main conclusions from the interviews are:

- Microsoft’s strategy of becoming a one-stop-shop for cloud-based business application has been well received by the SMB market in the three countries.

- The cloud-based SaaS delivery formats are gaining rapid market acceptance, and most reservations can be handled through proper coaching. The tipping point has been reached, and the market for cloud-based SaaS solutions may turn into a tornado in 2019.

- SMB customers expect their solution provider to coach them in the search for the best solution. In the lower end of the SMB market customers rely heavily on such guidance while customers in the high end of the market have internal IT-resources that specify the requirements.

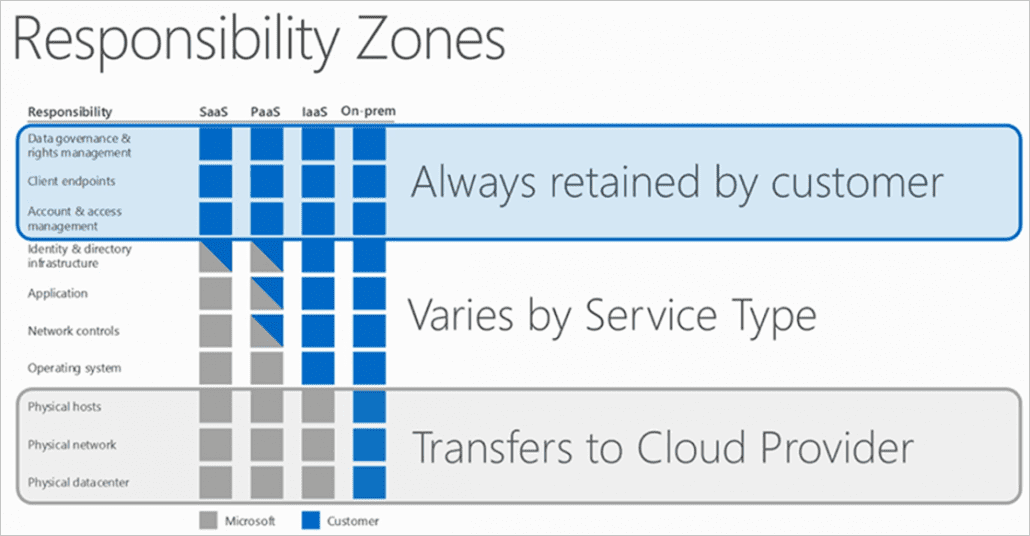

- IT- and systems support will not go away, and the SMB-customer still consider their solution provider their first line of support. However, technical support changes with changing technology. With more solution components and integration requirements, the need for business consultants and solution architects will increase.

- Customers do know what they want, but they cannot articulate how that translates into the need for information technology.

GCC Cloud Computing

Chris Harthman is the owner of GCC Cloud Computing that has been serving SMB customers in the UK with IT solutions, support and cloud services for more than 20 years. The company operates out of Birmingham, Gloucester, Bristol and London and offers a range of managed IT services and solutions based on technology from market-leading companies like Cisco, Hewlett-Packard, Microsoft and Sage. “We make the technology used by large corporations available to the SMB customer” is the company slogan.

“We are our customers’ IT-department,” says Chris Harthman. “They expect us to advise which technology best meet their requirements. More than ever we must translate industry hype and lingo into something that makes sense to the owner of a small business. She makes the final decision and has a very pragmatic approach to what her business’ needs.”

GCC Cloud Computing started as a Sage reseller and added Microsoft CRM when customers began asking for this type of service. Later they took on Dynamics NAV, which allowed them to serve larger customers.

“Customers do know what they want, but they don’t have the time to keep up with the development in IT-technology,” Chris Harthman adds. “IT-vendors keep releasing technology that in the first versions is not sufficiently robust and easy to use for an SMB customer with no internal IT-resources. We are the facilitator between the vendors and the end-user making sure the solutions work.”

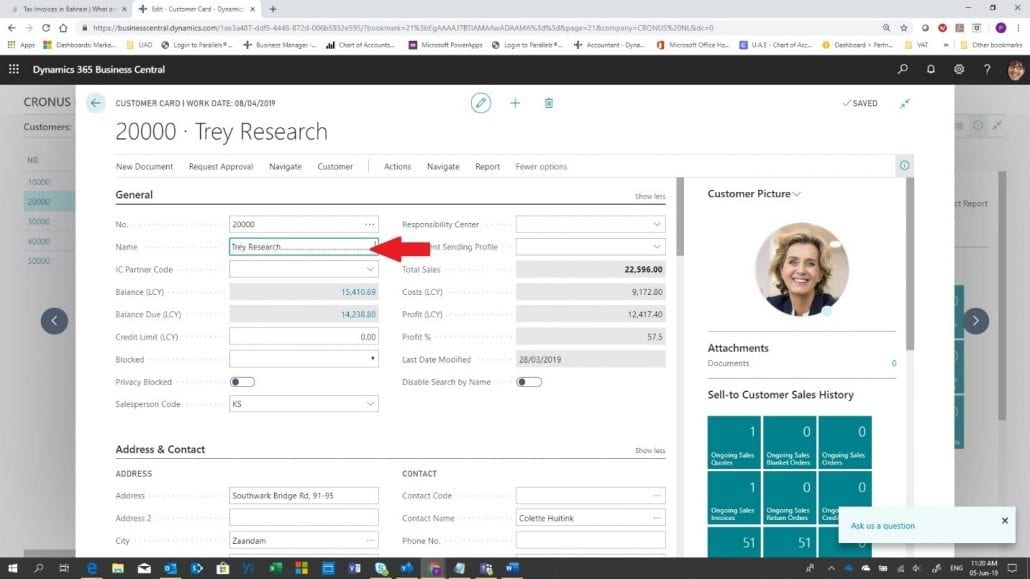

With Dynamics 365 Business Central GCC can now serve smaller customers also, and Chris Harthman has experienced a widespread acceptance of the cloud-based SaaS delivery format in the UK.

“While augmented reality and artificial intelligence still belong in the science fiction department, the cloud and SaaS delivery formats are widely accepted and even appreciated by the SMB community in the UK,” explains Chris Harthman. “Hardware and systems support will not go away but will play a minor role. Instead, there is a growing need for application support and business consulting.”

NAS conception GmbH

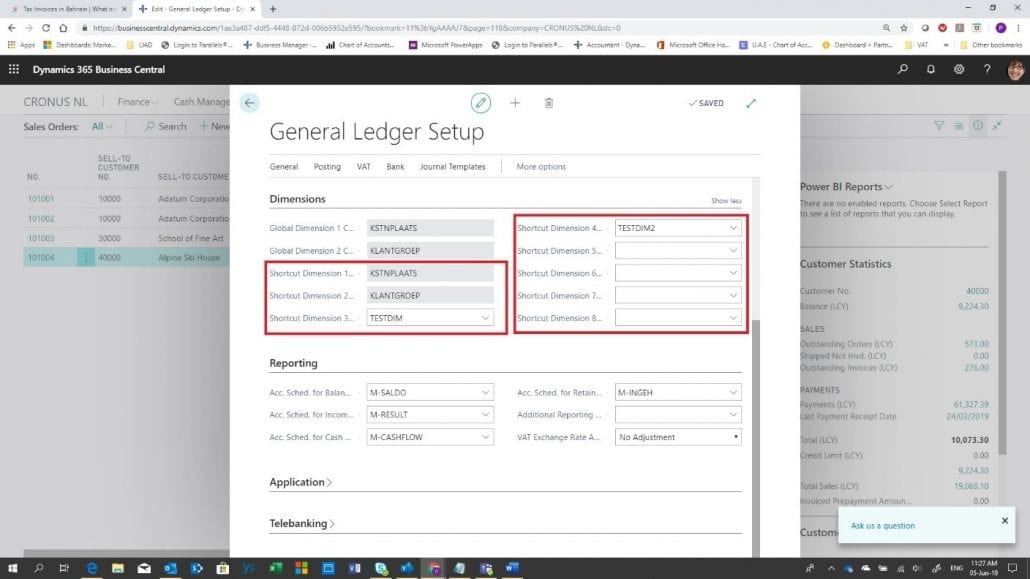

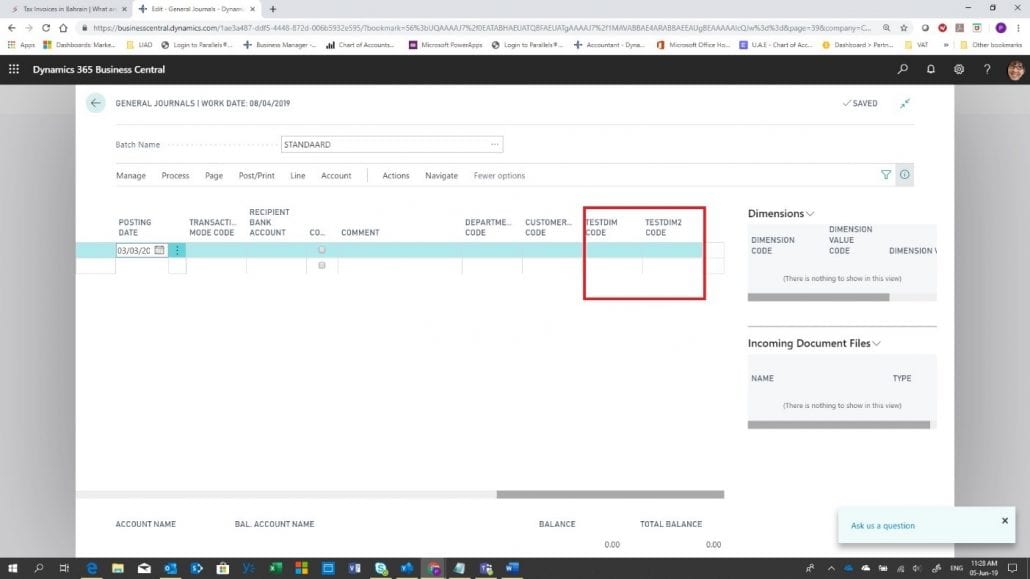

Nico Straub is the CEO of NAS conception GmbH in Düsseldorf, Germany. NAS conception was founded in 2012 to support digital transformation in the German “Mittelstand” (SMB-market). The company specialises in Microsoft Dynamics NAV, Microsoft Dynamics 365 (especially Business Central and Sales) and Microsoft Power BI. Microsoft Office 365 and Microsoft Azure complete the portfolio.

Through numerous customer and reference projects in recent years, NAS conception has gained industry experience and developed its own industry solutions or created them together with partners. NAS conception serves non-profit organisations (clubs, associations, fundraising organisations) with NC: Member and NC: Fund, the hotel industry with QuoHotel, and the real estate segment with HB Immobilien; all established and pre-configured industry solutions for Microsoft Dynamics NAV and Microsoft Dynamics 365 Business Central.

“Our customers are often not aware of the range of applications offered by Dynamics 365,” explains Nico Straub. “We advise them how they can best meet their business objectives and help them pick and configure the applications they need.”

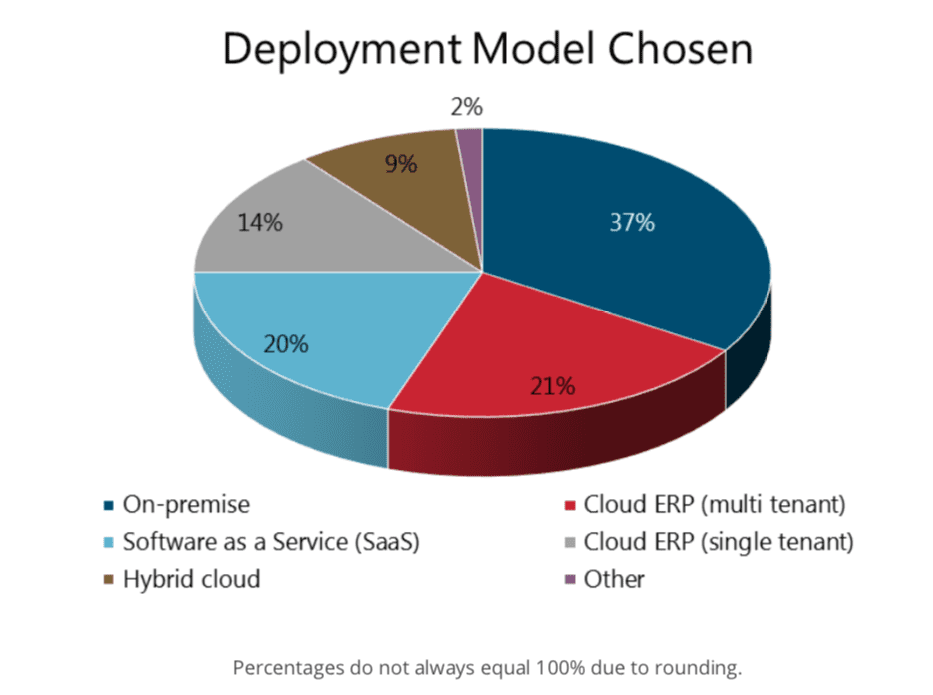

Given the reputation of the German SMB market being conservative and reluctant to embrace cloud-based SaaS solutions I am surprised to learn that most of NAS conception’s new customers choose Dynamics 365 in the cloud.

“If you run a market survey it may turn out that the majority of German SMB companies are reluctant to embrace cloud-based solutions,” admits Nico Straub. “However, the adoption rate is already high enough to keep us busy, and the speed is picking up. Also, the customer’s initial reservations often evaporate after we have had a thorough review of their business objectives and the solution options.”

Nico Straub had experienced how customers that were reluctant to take the cloud route changed their mind when the solutions were demonstrated and explained.

“Market surveys always have to be taken with a grain of salt,” says Nico Straub. “You ask customers about things that are not on top of their agenda, and they may not fully comprehend the issues. It’s no wonder you get a negative response. When you talk to customers with an active project and take your time explaining the options, then you get a different outcome.”

The shift from IT-support to business consulting is also something NAS conception have noticed, and that’s a change they welcome. Together with the introduction of the SaaS delivery format the initial investment threshold for new customers are lowered which again makes the purchase decision easier. The result is an increasing stream of new customers.

“The need for technical IT-consulting and customisation diminished as we move to cloud-based solutions,” Nico Straub stresses. “That leaves room for business consulting, integration and application support which is much more valuable to the customer. Microsoft’s investment in bringing all their applications to the cloud is first and foremost to the customers’ advantage. We must adapt and get used to serving many more customers as even advanced technology becomes available and affordable.”

Read also exclusive interview with Nico Straub about how he’s achieved a succesful cloud business.

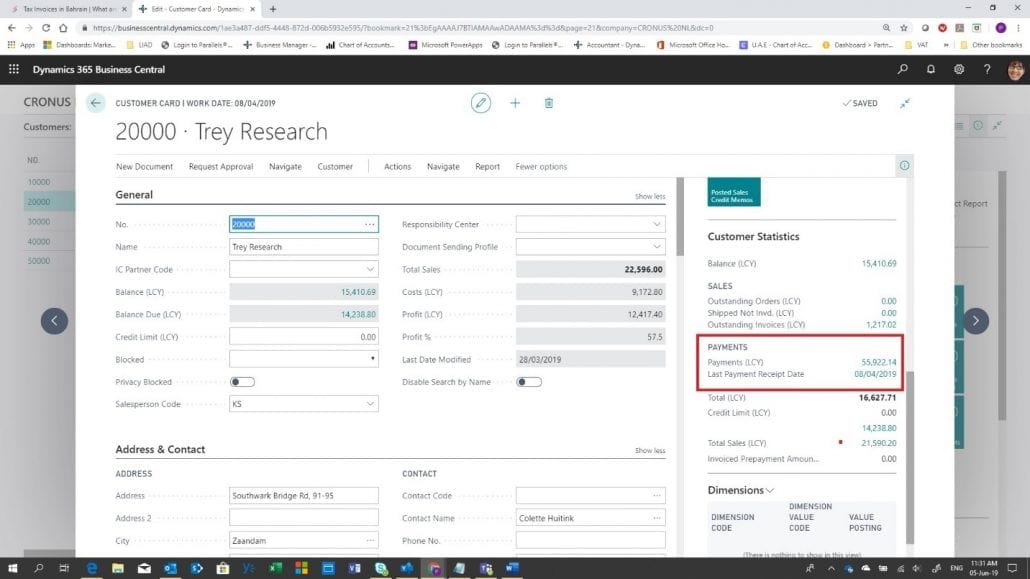

RelateIT

Simon Berthelsen is the CEO of RelateIT with offices in Odense, Kolding, Skanderborg, Søborg (Copenhagen) and Dubai. The company delivers ERP and IT infrastructure solutions to the higher end of the SMB market. The company was founded in 2012 by people with many years of experience from the ERP industry and from working with Dynamics NAV. Today RelateIT offers solutions based on Dynamics 365 Business Central, Power BI, and is a LS NAV (Retail) Diamond Certified Partner.

“The bigger the customer the more technology insight they have,” says Simon Berthelsen. “Our customers in general have very clear business objectives and understand the potential offered by the Microsoft Dynamics 365 platform.”

While many customers have moved to Office365 they are somewhat reluctant to make the same step for their core business management software.

“Migrating from an on-premise or Azure-hosted solution to Dynamics 365 is a mission critical project,” stresses Simon Berthelsen. “Customers are well aware that this is where they need to go in the future, but making the migration requires a compelling reason. We currently convert three to five customers per year and expect that rate to increase gradually. Within the next five to ten years, the vast majority of our customer will have completed the migration to a cloud-based SaaS solution.”

Customers expect their ERP partner to offer and support the introduction of IT into all corners of their business and RelateIT have embraced this opportunity.

“We team up with other partners in areas outside our core expertise,” says Simon Berthelsen. “The customers clearly prefer solutions that come from or are endorsed by Microsoft and they therefore turn to us first. A prominent example is Power BI that now has become the preferred business intelligence solution.”

Despite the accelerated availability of new technology in affordable and easily accessible formats customers still value a long-term relationship with their solution provider.

“We are not in a hit-and-run type of business,” Simon Berthelsen points out. “The value of our services is tightly associated with how well we understand the details of our customer’s operation. Combining that knowledge with a thorough understanding of Microsoft products is the secret source for success. Having long-term relationships is of mutual advantage to the customer and us. Such relationships are only maintained when we make recommendations in our customer’s best interest. That’s why business always comes before technology.”

The Lazy Bookkeeper and the Accounting Batman

These unusual names belong to Frederik Sandgrav, CEO and founder of the Copenhagen-based independent consulting firm Sandgrav Solutions, that help SMB-customers with bookkeeping including using information technology to streamline their financial processes.

Frederik Sandgrav attributes his success to the time when he wrote an article about the lazy little bookkeeper from Digitalia. Publishing the article on LinkedIn, he explained how the lazy bookkeeper could save time and money by using information technology to replace manual processes. The piece went viral, and customers came knocking on his door.

“I talk to SMB customers all day long and they all want the same,” says Frederik Sandgrav. “They want to save time and money, grow the business and make a higher profit. How to deliver on those business objectives using information technology is for us to explain and demonstrate.”

In 2017 Frederik was addressing an audience of a thousand SMBs gathered to hear about the future of accounting when he called himself Batman. Everyone knows that Batman is a human being. Perhaps a little more muscular than most, but his ability to fix mission-impossible situations is primarily due to his mastering of some fantastic gear. It’s the Batmobile and all the other high-tech gadgets that make Batman the ultimate problem-shooter. In fact, the technologies behind Batman’s gear are available to everyone; they just don’t use them.

“Customer do know what they want,” Frederik Sandgrav claims. “But forget talking about digital transformation, artificial intelligence, augmented reality, big data and cloud computing. That’s our language not theirs.”

**************************************

Recommended additional read: whitepaper “Microsoft Dynamics 365 the perfect platform for digital transformation in the mid-market“, which drills further into the market opportunities.

Since the beginning of the 1990s Navision Software had expanded internationally and with the immediate and enormous popularity of Windows 95, they had the distribution and partner network in place to deliver. Financials was the first financial management application to be certified for Windows 95 and they enjoyed the full impact of Microsoft’s global success.

Since the beginning of the 1990s Navision Software had expanded internationally and with the immediate and enormous popularity of Windows 95, they had the distribution and partner network in place to deliver. Financials was the first financial management application to be certified for Windows 95 and they enjoyed the full impact of Microsoft’s global success.