As part of the research for my next book, I have over the last 18 months been interviewing numerous B2B software companies about their international ambitions and activities. There are two significant trends worth mentioning, which will impact the Microsoft Dynamics channel operating in the mid-market also.

- The cloud has become a mainstream delivery format.

- Software customization is disappearing.

ERP-systems for the mid-market used to be the goose with the golden eggs. If you could deliver a customised solution to a client, then you had secured a handsome professional services business for the years to come. The initial customizations always became a little more expensive than initially planned because the customer changed her mind several times during the implementation phase. And with customization, everything was possible. For the ongoing changes and upgrades, you had a quasi-monopoly. Value-Added Resellers of ERP-systems just needed one or two handfuls of customers to run a very prosperous business, and many of them did just that.

For two reasons, those days are over:

- The customers paid the price, learned the lesson and don’t want to go down that road ever again.

- There is a choice of alternatives.

“The acceptance of cloud-based ERP solutions in the midmarket is very high,” says Christian Brinkmann, Partner with DataComfort in Denmark, “and the appetite for customizations is correspondingly low. Customers want standard systems and the software to service ratio for ERP systems is approaching 50:50, including data migration.”

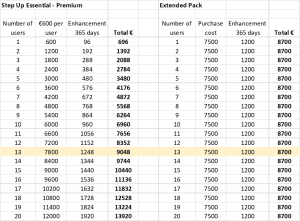

Christian Brinkmann explains that the project price may show a different picture because the final solution now consists of several software subsystems, integration, training and support. However, the cost per user of a contemporary ERP solution is declining, and the only way to make up for the shortfall is through selling to more customers.

Generic IT-skills are not enough

A little while ago, a web designer approached me concerning a redesign of my blog. She suggested it needed a facelift and she could do a customised solution for just a few thousand Euros. I was busy with other activities at that time and declined a conversation. A couple of months later the designer tried to reengage now offering a 25 per cent reduction in the price if the job was completed before a specific date.

I did agree on the need for a facelift, but not on the need for spending a few thousand Euros minus a 25 per cent discount. Had she approached me with a value proposition saying, “I can help you redesign your blog, so that it will attract more visitors and you will sell more books,” then I might have listened more carefully. We could have discussed how a new and customised design could best support my business objectives and maybe spending a few thousand Euros could easily be justified.

Instead, I did some research on the web and bought a portfolio of templates that I could try out and configure myself. Cost: $85. I am sure that the designer could have produced something visually much more sophisticated, but would it yield better business results and what would it cost to maintain?

The example illustrates what is happening across the entire software industry and now also hits the ERP-market. Customers are looking for business benefits first, then for the solutions that can deliver those benefits as fast as possible and with as little disruption, customisation and maintenance cost as possible. Adequate technical skills and product knowledge are taken for granted and doesn’t serve to differentiate. Domain insight and expertise are in high demand. The conversations customers want are about how to apply IT to improve on their business objectives.

VARs will have to become ISVs

Are businesses not different anymore?

Yes, they are still different.

Can they all use the same applications?

No, they cannot all use the same applications.

The difference from yesterday is the options now available for the mid-market company. The ISV market is snowballing developing vertical solutions that offer a much tighter fit with the customer’s core needs. On top of this massive specialisation, you find the power tools that enable customers to insource the development of some of those applications that make them unique. And finally, today’s APIs are well documented and support the best of breed movement that customers have embraced and adopted.

In the future, ERP-systems will comprise of standard configurable systems, power tools (aimed at citizen developers), external modules and integrations. How will VARs make their money in this world? What types of services are needed, how much of the total solution price will they makeup and are there new revenue streams available?

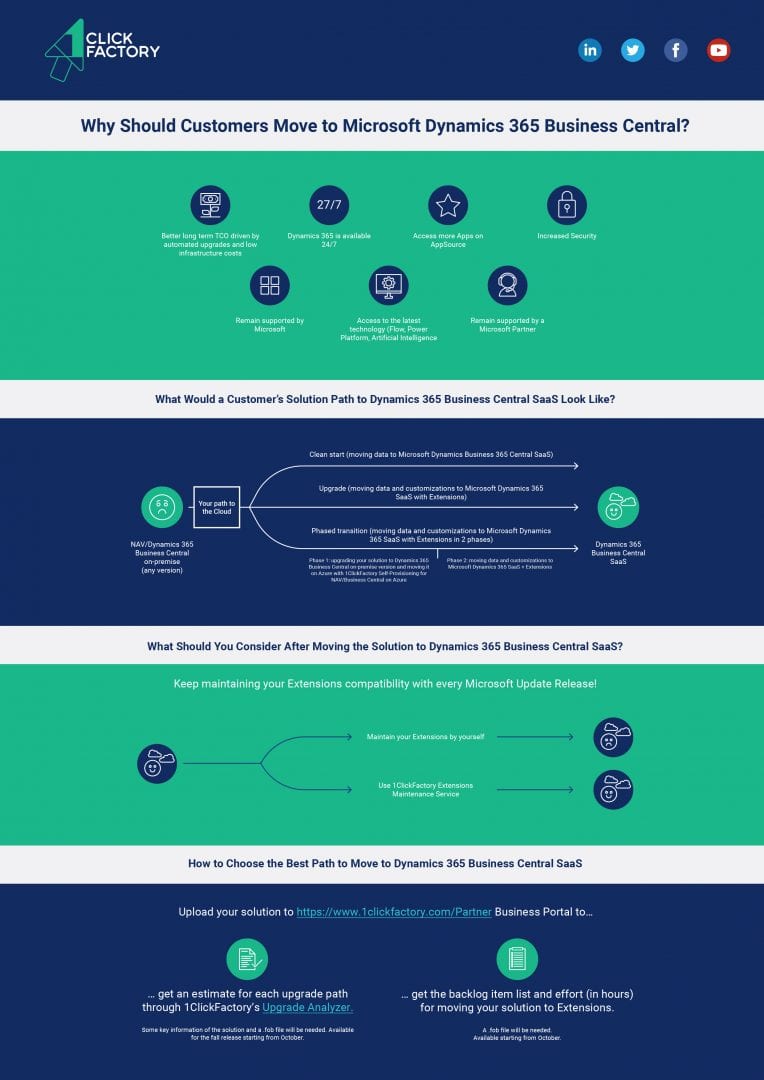

The customised ERP solutions in the mid-market will not go away tomorrow, but as they get ripe for replacement, the vast majority of them will want to move to a cloud-based standard SaaS-solutions.

The lion’s share of the professional services associated with specifying and developing customisations of EPR-systems will disappear and never return. The 10:90 relationship between ERP software and the associated professional services will change to something in the range of 50:50 or maybe even lower. The days of the traditional VAR approach offering to do bespoke develop of what the customer wants are coming to an end. They are outcompeted by ISVs that have made the investment in industry solutions with standard functionality that is much closer to what the customer needs. The customers enjoy the benefits of the ISV’s domain experience and are pleased sharing the cost of the ongoing development with her industry peers.

In 2017, partners earned $9.64 in revenue for every $1 of Microsoft revenue generated, and this is expected to continue through 2022. That amount includes a mix of software (45%), services (50%), and hardware (5%), that are sold in relation to Microsoft solutions. That mix also reflects a high ratio of partner-created products and services.

Source: The Digital Transformation Series, Part 1: The Digital Transformation Opportunity. Aligning business strategy to the digital transformation opportunity. An IDC eBook sponsored by Microsoft. 2018.

The quote above is from the first of five eBooks that IDC has written for Microsoft. The eBooks touches on various aspects of the digital transformation tsunami that all companies are facing these years. Digital transformation may represent a threat or an opportunity to the Dynamics channel depending on how you choose to react. Another quote from the eBook says:

According to the IDC partner survey, partners with IP services show the highest gross margins (more than 70%) and margins increase across all types of services relative to the partner’s digital maturity.

The ERP industry remains service driven, but product development, business consulting and systems integration replace bespoke programming.

I need a revenue generation specialist – not a designer.

My blog wasn’t falling apart, so why invest in a redesign?

Do I want to sell more books? Of course, I do, yet it is strange that hardly any of the web designers and SEO analysts approaching me leads with a value proposition directed at my business objectives. They all highlight what they do, not how they can help me get what I want. I am not expecting a performance-based proposal, although one that did play along this line would certainly catch my attention.

I am convinced that the future belongs to those who understand how to help their customers sell more, grow faster, reduce cost, improve productivity, hire better people, make more money, and so on. Business software, including ERP systems, can make a significant contribution to all those result-focused objectives, but how they will deliver that value mostly remains a generic and blurry marketing promise.

Customers are and will remain reluctant to invite a software vendor to perform a business consulting project pinpointing those areas where IT can improve the operation. The perception remains that you need product-independent consultants to perform such an analysis and not someone that will always point you to their product. I believe customers are making a significant mistake here, but we need to deal with this attitude for a while.

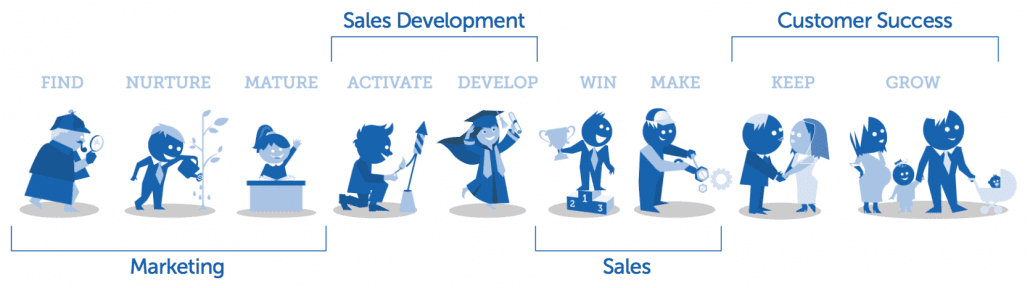

Now, let’s imagine that you have substantial domain-insight and can present a series of customers in the same line of business where you have helped improve business objectives. Let’s also imagine that you have accumulated data for the performance in the industry and turned this into a tool where potential customers can benchmark where they stand. If you can make the potential customer take the benchmark and self-diagnose, then you have a platform for a business-driven dialogue.

If you do so, then you’ll end up with customers that fit your product portfolio, which again will reinforce the credibility of your customer value proposition to others in the same industry. You will accumulate domain insight at becoming steadily more relevant and valuable to your customers.

The core value of this type of business consulting is your ability to create the relationship between the IT-products and services that you provide and the tangible and measurable outcome for the customer.

Can you charge for business consulting or will the customers expect this as the free presales effort you need to deliver to get the contract? I agree that this is a challenge. However, as your reference list in the industry grows, the more motivated the customers will be to confirm the fit.

Not all customers will be receptive to the approach. Some will continue being reluctant to share such business details with a potential vendor. Some will be afraid that it will damage their negotiation position if you know how attractive the investment is. Maybe you should walk away from such potential customers anyway.

If you love software development, then you should become an ISV

Looking back at the little example from my won world, I ended up buying a theme-package from an ISV for $85 (annual subscription). The themes are developed specifically for content producers such as me. I can do the customization myself and get the functionality missing by activating third-party add-ons. The ISV claims to have 30.000 customers who represent an annual revenue stream of over two million dollars! I don’t know where they are located because that makes no difference for the type of relationship I want with the supplier.

The need for industry and customer-specific functionality that is not available in Microsoft Dynamic’s standard packages will always be there. You can deliver it in four ways:

- By configuring the standard software and using custom fields

- By using the Power Tools

- By implementing an app from the AppSource

- By integrating to another app

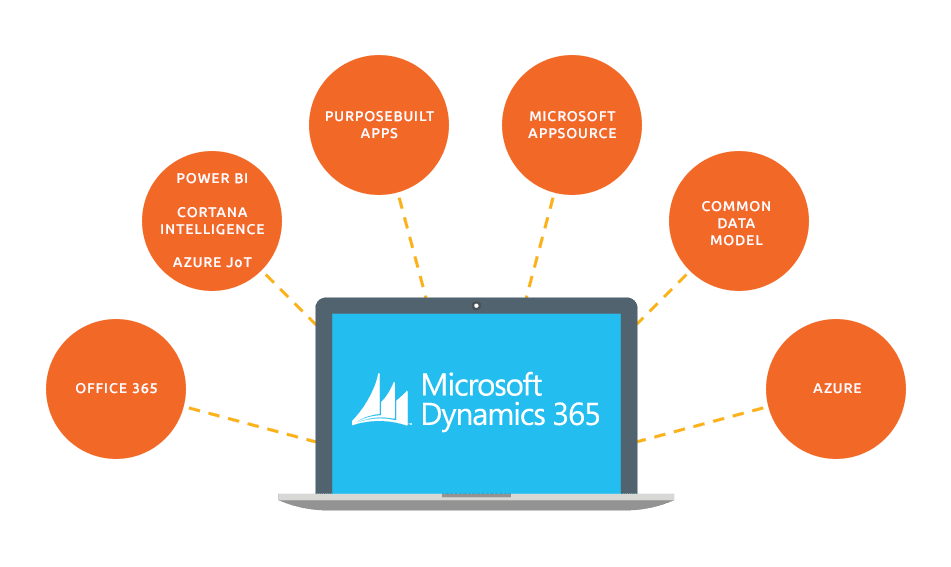

Within a year the number of apps available for Business Central in Microsoft’s AppSource has grown from 43 to 435, and I foresee that this number will explode as software developers realise the potential of the Dynamics 365 platform and the business it can generate.

Developing customizations and apps may seem like almost identical activities, but that is not the case.

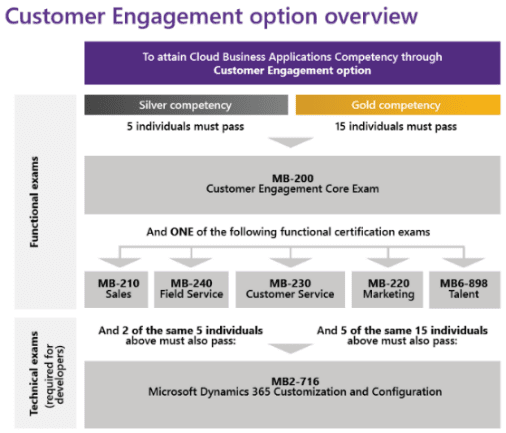

“Getting an app into AppSource is associated with substantial overhead compared to the bare development,” says Nelson Tavares da Silva, VP of ISV business development with the QBS Group. “The upside is access to Microsoft’s marketing muscle and the captive Dynamics 365 market. You can offer apps that are not certified by AppSource, but how will you then communicate them to the market? I also believe that customers will be increasingly reluctant to buy them since they are not guaranteed the quality and the upgradeability offered by the AppSource.”

Customisations were an attractive short-term business opportunity since the customer paid the full bill. ISV solutions follow a different business model, where both the initial and the ongoing investments in the product are higher, but the potential for repetitive sales much more likely and much more profitable. Scaling a product business is much simpler than scaling a service business, and we will see ERP-ISVs that go for international market coverage. Those that succeed will be very hard to beat. Through the transparency of the internet, the customers will find them, and over time, they will grow to become global players.

“Every VAR is transitioning to be an SI,” concludes Nelson Tavares da Silva. “With AppSource, customers will force VARs to be an app integrator whether they like it or not. VARs are looking to form the partnerships with ISVs that will form their proposition for the next decade.”

In the mid-market for ERP-systems, the future seems to belong to the ISV.

*****************************

If you liked this article – you might also enjoy reading our White Paper “The Microsoft Dynamics ecosystem must win more customers”

Or reach out to our VP of Business Development – Nelson Tavares da Silva for a personal advise.